Main Industries’ Pain Points and How Approval Workflow Can Help

Infographic based on over 100 of ApprovalMax recent clients’ businesses

Whether you realise it or not, your business has workflows. And important approval workflows can be introduced into any type or size of business, ensuring correct procedures are followed when paying your bills, making new purchases, or requesting reimbursement.

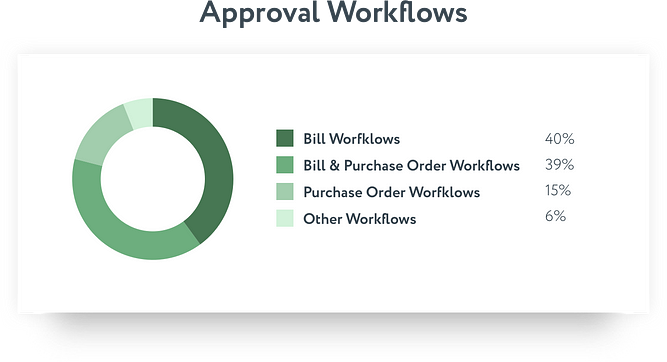

In fact, any number of vital approval workflows can be implemented and automated. However, here at ApprovalMax, we focus on helping our clients automate the following main approval workflow types:

As you can see, the vast majority revolves around these two main accounting approval workflow types — Bill & Purchase Order. At the same time, based on our experience, every organisation has a unique approach applied to handling them. This way, every industry will benefit in its own unique way from approval automation.

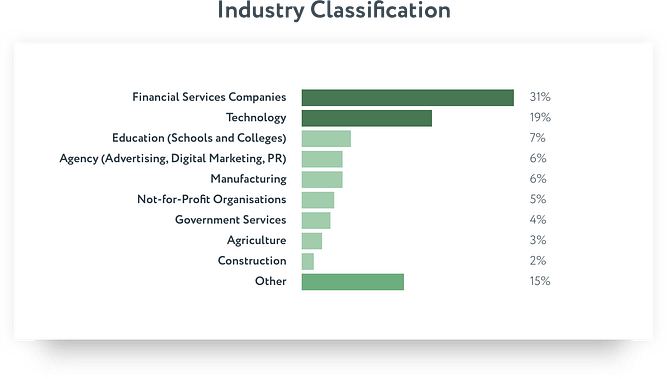

To understand them better, this month we’ve looked at over 100 of our recent clients’ businesses to understand the business use cases better.

Based on our analysis, this is how our segmentation currently looks:

Let’s take a look at what we’ve discovered about these industries’ main pain points and benefits:

Financial Services Companies

This is our major focus area. We are a solution of choice for both internal accounting departments of financial services companies and their clients. In general, both of these parties have been able to significantly improve the accuracy, transparency, and scale of their accounting processes.

To be more specific, we mostly deal with invoice submission — something that even the most basic approval process can improve. For instance, there may be monthly invoices from suppliers, third-party contractors, or even employees, so creating a reliable, recurring internal approval process will help ensure that everyone is paid on time — and paid correctly.

At the same time, by implementing an approval process for purchase orders, businesses can monitor the pace of purchase requests, manage resource and time, and quickly provide an accurate log of external business.

Technology

For highly-dynamic companies, priority is placed on ease of adoption and use of any software.

The same applies to accounting approval management systems. Also, specific focus is made on adaptability. When approval workflows are automated — replacing manual processes and paper documentation with automated online processes and an electronic equivalent — you need to be able to customise your workflows to adhere to your particular way of carrying out and completing processes.

Education

In education, whether it’s a large university or a local school, when it comes to managing accounting approvals, visibility and control are critical. Educational institutions deal with a tremendous amount of paperwork and regulations that must be managed daily, which puts additional stress on how you perform payment authorisations.

By automating accounting approvals, you significantly reduce the volume of paper and manual clutter, with efficient and productive processes excelling in its place.

Agency (Advertising, Digital Marketing, PR)

There are a great number of challenges experienced by brands and ad agencies when it comes to managing finance approval workflows. Inefficient processes, missed deadlines and budget fallouts are just some of the typical issues we hear about.

Since processes are different in all the organisations, it’s essential to have an approval process that supports non-standard approval practices and approval roles in place.

Agriculture

As with other industries, the traditional approval workflow in agriculture is slowed down by extensive paperwork and unanticipated delays.

On Wednesday May 9th, we hosted a Webinar where we talked about best practices for implementing a fully-digital ecosystem, with special focus on expense management and spending optimisation.

It’s a free session with heaps of value. Advice was shared by Anthony Burman, CFO of one of the largest agribusinesses in the Southern Hemisphere, Fieldays Society.

To watch the recording, follow this link.

Construction

Construction projects usually involve a parade of finance approvals. Data volume and communication misunderstandings can lead to higher costs and increased time waste.

Both multi-step and multi-level approvals make sure that all important approval decisions are carried out by employees with the proper authorisation level. They also ensure employees are doing so while remaining compliant with corporate and regulatory requirements.

In Summary

Implementing financial approval workflows and process automation can enhance the effectiveness of internal operations for organisations of all shapes and sizes, and across a wide range of industries.

You can expect productivity to go up, with simple tasks carried out faster and more efficiently than before. And errors are minimised, meaning less time spent tossing paper around.

Next time, we’ll discuss the other industries in more depth — stay tuned to learn more about our approval solutions for Government organisations, Not-for-Profits, and Manufacturing Industries.