Establishing financial controls using a Xero-based Bill Automation app stack

Financial controls are the processes, policies and procedures that are implemented to manage and oversee finance and accounting activities. Examples include: accounting standards; approvals and delegations; audit trails; and informational security.

In this blog post, we look at the importance of financial controls, and how to introduce them via a Xero-connected Bill Automation app stack.

The importance of financial controls for financial service outsourcing (FSO) organisations:

FSO organisations have a unique demand for financial controls because of:

- An increased time and effort to communicate and coordinate with multiple decision makers on the client’s side. This is because the decision makers are remote, but are nonetheless involved in daily authorisation activities.

- A demand for shared accountability for decision making with clients. This helps make sure they are not solely responsible for erroneous or fraudulent payments in such cases where they could not get timely approvals on the client side.

- The need to have exceptional data quality – all the correct coding, bills matched with the corresponding POs, timely reviewed and approved bills – in order to be able to deliver high value services such as cash flow forecasting, and financial advisory.

Keys to efficient financial controls: Digital and fully automated processes

Xero’s latest Cash Flow App Advisory Playbook outlined the importance of Data Automation. Modern cloud technology has been widely embraced, and manual interventions and paper-based processes all but eradicated. Functions such as invoice submission, practice management, client management, and approval management have all benefited

To take the first step towards Data Automation, you must introduce digital data capture and cloud data storage for accounting documents.

Once you have your data in a digital form, you can start introducing Data Automation, which is essentially an extension of data digitisation with workflow driven data validation and decision control. This makes sure that your accounting data is complete, verified, and auditable.

Building a Xero-based Bill Automation app stack

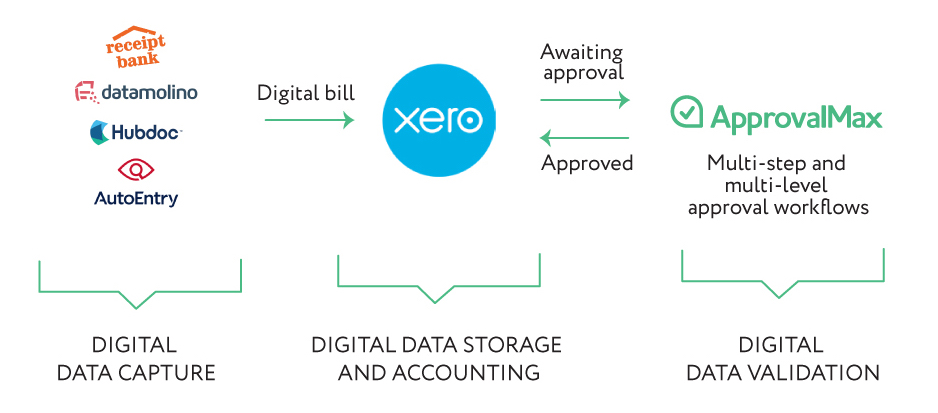

A Xero-based Bill Automation app stack consists of the following:

- Xero as the cloud accounting platform. It should be used for cloud data storage, centralised document management, and accounting.

- Digital data capture tools, such as Receipt Bank, Datamolino, AutoEntry, and Hubdoc.

- Online approval workflow apps, such as ApprovalMax. This should establish the multi-tiered and fully automated approval workflow, based on the approval criteria pulled from Xero – for example: Supplier, GL code, Amount, Tracking Category, etc.

Results of introducing financial controls for accounting and bookkeeping practices

There are a number of benefits to introducing financial controls, such as:

- A streamlined client communication and strong authorisation process for all financial documents, including POs, Bills, Credit notes, etc.

- A fully automated and notifications-driven authorisation process for multiple remote budget holders and decision makers on the client side.

- Positive profitability by ensuring data quality through timely review and approval of all financial documents.

- Higher client satisfaction due to better transparency and process agility.

- A reduction in time and costs, and improvement in audit quality using automated audit reports attached to every bill and PO.

- Improved cash flow analysis by taking into account pending POs and bills which require approval and that are not yet reflected in Xero.

The bookkeeper’s guide to efficient invoice approvals

Learn how to strengthen your accounts payable process with approval automation

Download now