Bill automation tech stack: establish proper financial controls for accounts payable

For accountants and financial advisors it’s crucial to deliver their services cost-efficiently while ensuring client satisfaction. Luckily, modern technology can take off the edge and make things a lot easier. Implementing the right tech stack eliminates common obstacles in invoice processing such as manual data entry and email clutter. It also solves the complexity of getting proper authorizations from remote client budget holders.

How to build such a tech stack? Well, let’s start with the three essentials of end-to-end automation for accounting tasks:

Data automation

All operational data needs to be digitized and stored in the cloud to have them readily available for both the accountant and clients. Efficient financial advisory relies on accounting data that is enriched with business context to make it actionable. In practical terms this implies extending GL codes with business-oriented coding so that accounts payable and accounts receivable information can be translated into company performance indicators. Such business-oriented codes are always specified together with the client and then continuously validated by their decision makers via timely reviews and approvals.

Workflow automation

Efficient process automation is vital for the successful delivery of advisory services. Client collaboration needs to run seamlessly and this simply cannot be achieved using paper or email-based systems for task handovers. Here, an application that automates workflows, sends push notifications, allows real-time status tracking and keeps processes on the surface is a real game changer. Everything is executed exactly as predefined with cloud-based workflows that also capture the complete history, which leads to significantly less time wasting.

Customer experience

Frictionless collaboration with clients is business-critical, as is outstanding customer experience, so it’s important to leverage technology to the fullest. Mobile apps for successful client communication are a key element for ensuring swift and easy collaboration. They provide access to relevant data on mobile platforms and facilitate interaction with clients regardless of their location.

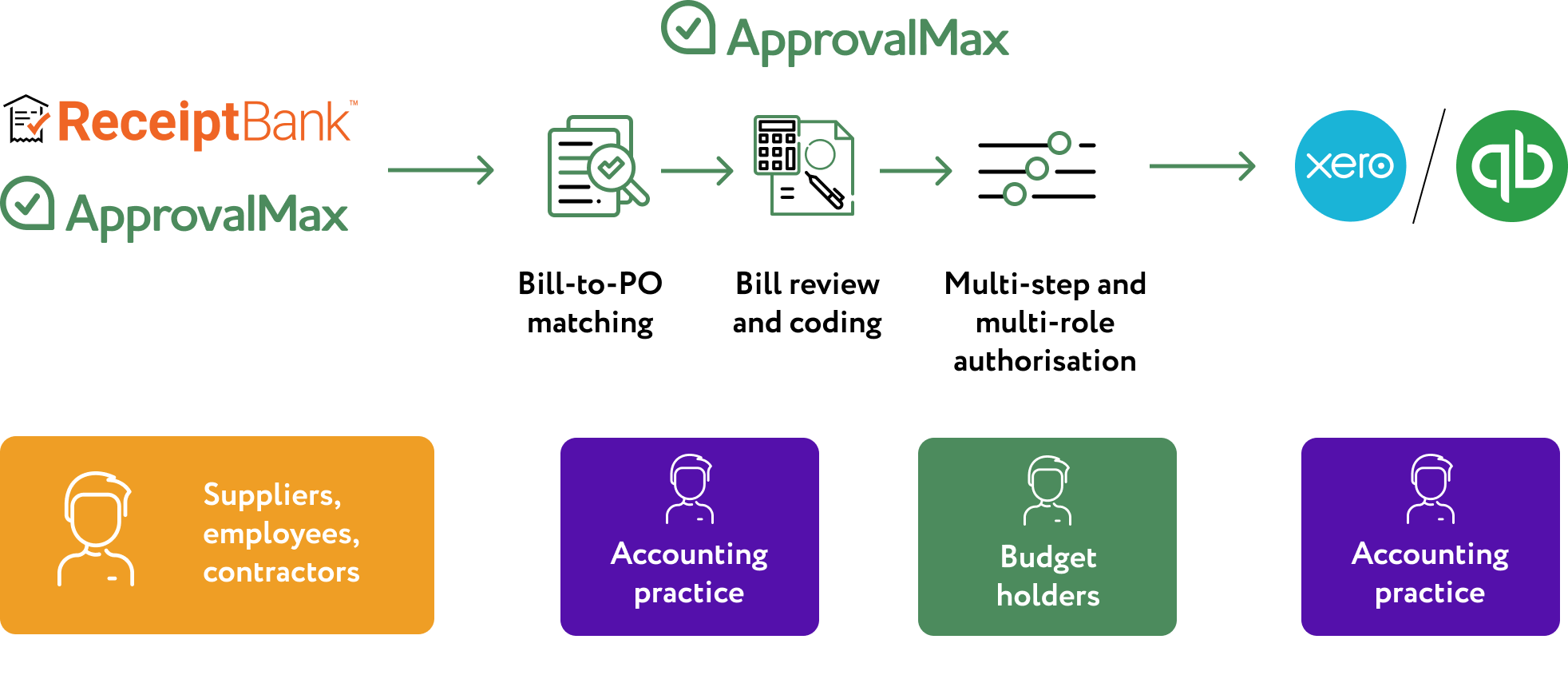

QuickBooks Online + Receipt Bank + ApprovalMax = an end-to-end bill automation app stack that covers all these essentials

This workflow setup enables access to real-time verified data that can be used for spend control, reporting and cash flow forecasting. The seamless integration between client-facing tools (Receipt Bank and ApprovalMax) and the cloud accounting system on the advisor’s side enables efficient collaboration with the client and ensures great customer experience.

This is how it works:

Digitizing invoices

The first step of end-to-end automation is creating digital bills: Receipt Bank extracts the relevant invoice data, enters this information into the fields of a digital bill and then attaches a scan of the original invoice. These digital bills including their attachments are subsequently published to ApprovalMax for authorization.

Alternatively, bills can be created directly in ApprovalMax by authorized users like suppliers or contractors. For this, all the relevant information such as supplier name and inventory items is automatically synced from the cloud accounting system to enable the same user experience as if working in QuickBooks Online.

Both invoice digitization methods prevent unauthorized bills in the accounting system and shield sensitive accounting data from users who submit bills.

Validating data

For all bills with a corresponding approved purchase order it is possible to match bill and purchase order in ApprovalMax, which includes copying certain information such as the bill’s coding from the original purchase order. This step is optional.

No matter which way bills arrive, after entering ApprovalMax they will be reviewed and coded by an accountant first. In this step, the accounts and tracking categories are checked to ensure that the spend allocation is correct.

After this initial control, usually performed by the accountant, bills are routed to the responsible budget holders on the client side. ApprovalMax runs a fully automated multi-step and multi-role authorization process which is based on one or several criteria pulled from the accounting system (supplier, amount, GL code, tracking category, etc.). The highly flexible approval matrix can easily be extended to suit growing businesses with increasingly complex spend tracking patterns and a rising number of approval criteria that need to be accounted for.

Pushing approved bills to the accounting system

After full authorization, outstanding bills are pushed to the accounting system marked as ready to be paid. Any bills that have already been paid before approval will be published to the accounting platform together with the payment information. An audit report that captures the authorization history including approver comments is created automatically and attached to each bill; it can be viewed directly in the accounting system.

When implementing a reliable foundation for the delivery of complex business-oriented financial services, you’ll need the best technology available and this data and process automation app stack really is cutting edge: truly real-time and actionable data, efficient and fully automated workflows and, last but not least, higher client satisfaction. Accountants and financial advisors who employ the app stack enjoy the following benefits:

- Full data and process automation for accounts payable to establish actionable data and enable easy contextual client collaboration

- Complete eradication of error-prone processes based on paper or emails and real-time data in an instant

- Data accessibility at any time from any device in any location, with everything under control in automated processes on the surface

- Centralized spend control through approval automation as well as shared accountability with the clients regarding payments

Join our webinar on November 19, 2020 at 12:00 p.m. EST to learn about the other opportunities this tech stack opens up!